When you have many different companies in your portfolio, you cannot make rational business decisions based on your own impressions or opinions. The McKinsey matrix allows you to look at the company's future in a broader plan and make the best decision from a distance.

What is a McKinsey matrix?

Today's market is largely dominated by corporations. Large companies often have several dozen or even several hundred different companies in their portfolios. This trend started to be visible in the 1970s. It turned out that it is quite difficult to manage such a huge enterprise with the old methods. This is how the McKinsey matrix was created, prepared by the consulting company McKinsey for General Electrics. Hence, the term "GE matrix" is sometimes used interchangeably. This system is based on a similar, but less extensive one growth and share matrix.

The McKinsey matrix consists of areas that allow to assess the prospects of individual companies belonging to a given corporation. Having dozens of entities from various industries "underneath you", it is impossible to judge which of them gives a chance for profit. It is difficult to compare them without taking into account the specificity and value of a given market. This is why The McKinsey matrix compares the company against other companies in a given sector, as well as the development prospects of the entire sector. This allows you to make more rational business decisions. For example, the market of meat substitutes in Poland does not look very attractive compared to others. Knowing, however, that it has been growing by 100 percent in recent years. annually, and having a prospective company in your portfolio that deals with this type of food, it can be assessed that it has a good chance of success in the future.

The stages of preparation of the McKinsey matrix

In terms of structure, the McKinsey matrix resembles other methods of analyzing the company's potential, such as Porter's five forces analysis, the Osterwalder model if PESTEL analysis. It consists of the following steps:

- determining the company's competitiveness on the market and the factors that determine the attractiveness of this market;

- Ranking of these factors in terms of importance on a 0-1 scale;

- assessment of individual factors on a scale of 1-5;

- determining the attractiveness of the market and the company within this market.

Based on this, a matrix model can be built. As you can see, it is worth carrying out the very first step of this analysis, because it gives you an insight into the market situation. So, if your company is not yet one of the corporate giants, and building the entire McKinsey matrix seems too complicated for you, at least take care of this first stage and look at the conclusions.

It is worth analyzing the attractiveness of the entire market not only now, but also in the future. This way you can check if your communication strategy, methods of operation and goals provide perspectives. The second component of this step is the analysis of the company's competitiveness against others in a given market. Factors that determine the attractiveness of the market are, for example, its growth rate, size, achievable income. Factors determining the company's potential are, for example, recognition, reputation or offer. You can change them over time, adapting the company to the realities of the market.

Your company has potential - use it!

Check how we can help you.

How to use the McKinsey analysis

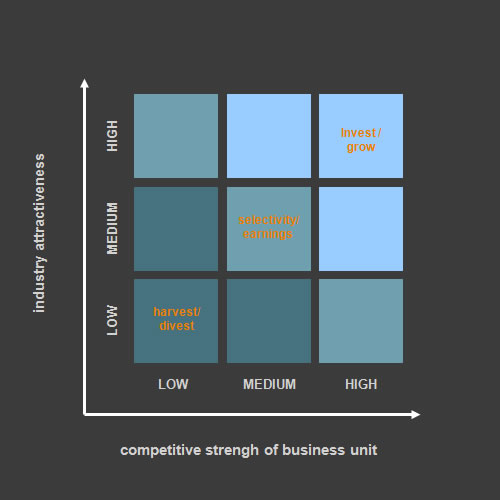

If you want to prepare the entire McKinsey analysis, you still have to give specific weight to individual aspects of the market or the company's operation. You will get a result that will help you determine whether the market attractiveness and competitive position are high, low or medium. It is necessary to superimpose 9 fields characteristic for the McKinsey matrix on such a graph. Each of them identifies a different strategy proposed as an ideal solution in a given situation. These strategies are:

- transitional,

- withdrawal,

- growth.

If it turns out that your company can adopt a growth strategy, it means that it is worth investing in its development and implementation sales support. Perhaps not today, but in the end, spending on innovation, building customer awareness or expansion will pay off. This explains why many corporations invest heavily in seemingly insignificant industries. This was the case, for example, with Uber, who over the years was developing a seemingly hopeless project that brought him almost a billion dollars a year in losses in 2016. Only with time did it start to make a profit. The transition strategy may be otherwise called the "wait-out" strategy. The industry is not so promising or the company is not that competitive, but it is worth keeping it alive, because the situation may change in the future. The withdrawal strategy is of course a situation in which it is no longer worth investing in a given company - it is better to sell it or close it.

Advantages and disadvantages of the McKinsey matrix

The big advantage of McKinsey matrices is that analysis can thus be carried out quickly even complicated business cases. Sentiment or personal convictions go away here - if you can see clearly that the company should withdraw, there is no point in cursing reality. On the other hand, a seemingly not very exciting topic may turn out to be very interesting when you look at the market development prospects and the position of a given company against the competition. In your analysis, you are also not doomed to any objective factors that are of little importance to you. In the above analysis, we have given an example of factors often selected for comparison, such as growth rate or market size. However, it can be any other characteristic, such as environmental friendliness or inclusiveness of a given market. However, there is a major disadvantage of the McKinsey matrix with this.

If you base the entire analysis on irrelevant business factors, and then make the most financially viable decisions on this basis, you may lose. All this describes the company in the present tense, and the market - also in the context of future prospects. This can sometimes blur the picture, for example, if the company is about to undergo transformations and the competition makes some unforeseen move. Therefore, like agile marketing allows you to modify your marketing strategy on an ongoing basis, yes, matrix analysis McKinsey it should be repeated over and over again to get a meaningful result.

Is it possible to make the most important business decisions only on its basis? In the reality of a small company - no. Situations can change, and you must take into account your own needs and beliefs. However, in the case of large companies, no better method has yet been invented that would allow them to quickly judge what is worth investing in.