When organizing an integration event with the Company Social Benefits Fund, there are many questions that companies are looking for answers to. What is an integration event with the Company Social Benefits Fund? Who and when can organize such an event? What conditions must be met to be able to use the Company Social Benefit Fund. We have collected the most common questions in this article. We will try to dispel all doubts.

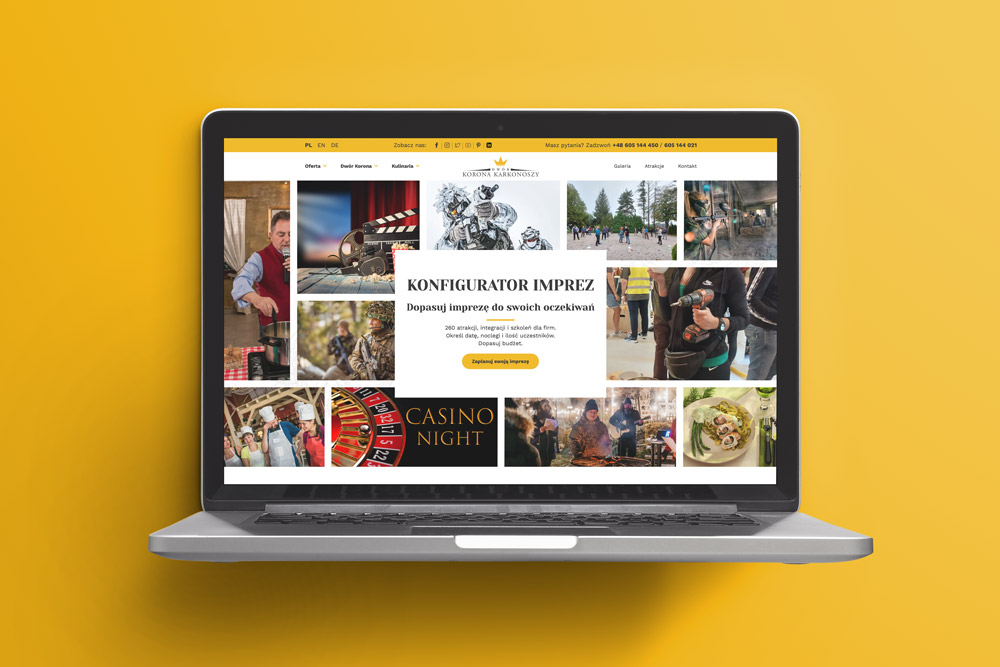

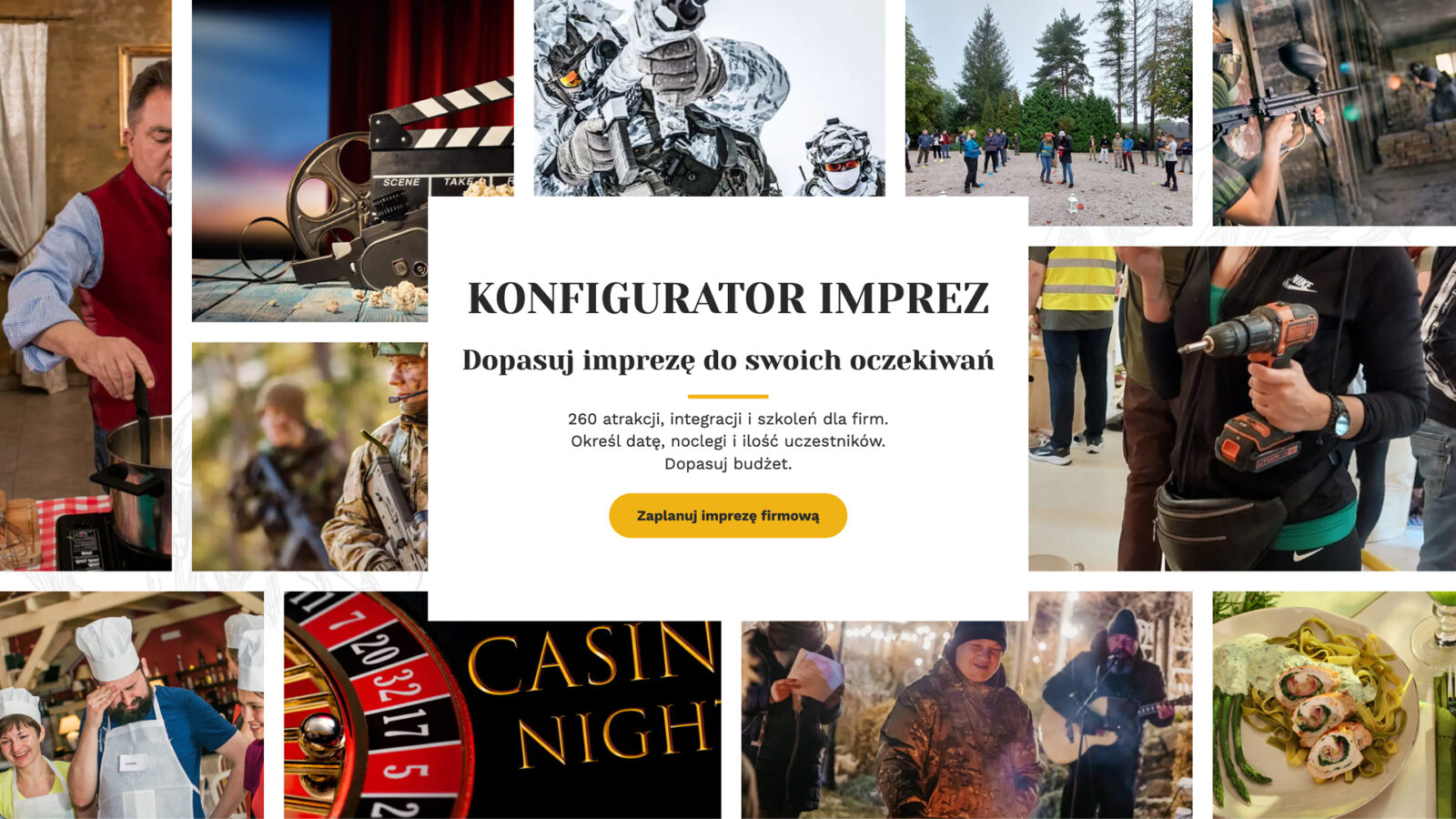

CLICK below in the Corporate Events Configurator banner

What does the abbreviation ZFŚS mean?

The Company Social Benefits Fund, i.e. the Company Social Benefit Fund, is specially collected funds by the employer in order to use them for social support for eligible employees in certain situations. The company collects money on a separate bank account. A social fund can be created by companies that employ more than 50 full-time employees. Nowadays, this fund is rarely used by employers, however - they have such an opportunity.

How to make good use of the funds of the Company Social Benefits Fund?

Organize an unforgettable team building for your employees!

Use of the ZFŚS fund

An integration event with the Company Social Benefits Fund, in order to be organized, must meet specific conditions. The Act of March 4, 1994 on the Company Social Benefit Fund (consolidated text Journal of Laws of 1996 No. 70, item 335, as amended, hereinafter the Act on the Company Social Benefits Fund) clearly defines what the funds can be spent on, which is:

- social activities organized by the employer for the benefit of persons entitled to benefit from the Company Social Benefits Fund,

- co-financing for company social facilities,

- creating forms of pre-school education (company nurseries, kindergartens, children's clubs).

Integration event with the Company Social Benefits Fund - costs

It is necessary to distinguish between events financed entirely from the Company Social Benefits Fund and those financed entirely from working assets. In the first case, the integration event, which was entirely financed from the Social Fund, charges the employer only with administrative costs. This significantly relieves the company's budget, which makes it worth choosing this option. In the case of events financed from current assets, all expenses incurred can be included in tax deductible costs under a certain condition:

- if and only if the aim of the event is to integrate employees and improve the atmosphere in the workplace, as well as to create a well-coordinated team, motivated to continue working.

integration Party

Remember! If the employer intends to include the integration meeting in the operating costs, only employees may attend the event. It just means that their family cannot attend the event. If the company decides to invite its relatives as well, it gains the right to deduct the costs incurred for each employee. If the employer is particularly interested in this, he must prepare a detailed statement of costs incurred and separate the part that he allocated to his team.

Examples of integration events as part of the Company Social Benefits Fund

An integration event with the Company Social Benefits Fund must be included in the social activities, i.e. cultural and educational activities as well as sports and recreational activities. Cultural activity is based on the promotion and protection of culture, and organizational forms include cinemas, theaters, philharmonics, museums, and art galleries. In turn, in the field of relaxation there is sport, recreation and active rest.

Thus, in order to organize an integration event from the fund, it should be combined with leisure, cultural activities or sports. An example of such events is a company trip with visiting museums, kayaking or mountain climbing. Another example is an integration event in the form of an evening during which a music band performed and the participants were given a meal. Such action is the most appropriate and consistent with the applicable regulations.

If the same company wanted to organize a Christmas party and finance it from the Company Social Benefits Fund, it would act against the act. Why? Because it is difficult to recognize that the party was a form of rest, sport, recreation or a form of cultural activity. When financing integration events from the Company Social Benefits Fund, it is not necessary to take into account the social criterion, which means that all employees can participate in the event on the same terms.

CLICK below in the Corporate Events Configurator banner

CLICK above in the Corporate Events Configurator banner